Mastering Customer Segmentation with RFM Analysis: Boost Engagement and Revenue

Introduction

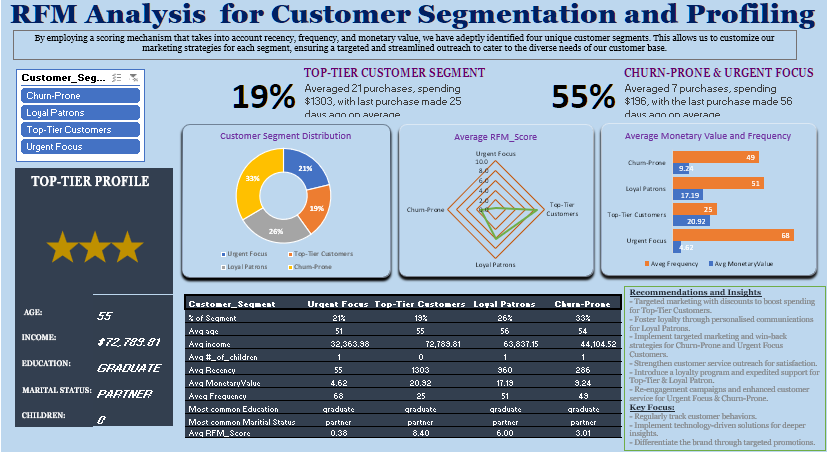

In today’s competitive market, understanding your customers is more critical than ever. RFM analysis—a powerful segmentation technique—helps businesses categorize customers based on their purchasing behavior. By evaluating Recency (how recently they purchased), Frequency (how often they purchase), and Monetary Value (how much they spend), companies can unlock actionable insights to enhance customer relationships and drive revenue.

What is RFM Analysis?

RFM analysis breaks down customer data into three key dimensions:

-

Recency (R): Measures the time since a customer’s last purchase. Recent buyers are more likely to engage again.

-

Frequency (F): Tracks how often a customer makes purchases. Frequent buyers are often more loyal.

-

Monetary Value (M): Assesses the total spending of a customer. High spenders are typically your most valuable segment.

By scoring customers in these areas, businesses can create segments like "Top-Tier Customers," "Loyal Patrons," and "Churn-Prone" to tailor strategies effectively.

Key Insights from RFM Analysis

The analysis of 2,213 customers revealed:

-

Top-Tier Customers (19%): High spenders with frequent purchases and recent activity. They averaged 21 transactions, spending $1,303 per purchase.

-

Loyal Patrons (26%): Regular buyers with moderate spending. They averaged 17 purchases, spending $960 each.

-

Churn-Prone & Urgent Focus (54%): Customers at risk of disengagement. They averaged 7 purchases, spending $196, with longer gaps since their last purchase.

Actionable Strategies for Each Segment

-

Top-Tier Customers:

-

Reward loyalty with exclusive offers, VIP perks, or early access to new products.

-

Personalize recommendations based on past purchases.

-

-

Loyal Patrons:

-

Foster engagement with targeted promotions and personalized communication.

-

Introduce a loyalty program to encourage repeat purchases.

-

-

Churn-Prone & Urgent Focus:

-

Launch re-engagement campaigns with special discounts or win-back incentives.

-

Improve customer service outreach to address concerns proactively.

-

Implementing RFM Analysis in Your Business

-

Data Collection: Gather transaction data, including purchase dates, order frequency, and spending amounts.

-

Scoring: Assign scores to each customer for Recency, Frequency, and Monetary Value (e.g., 1-10 scale).

-

Segmentation: Group customers into segments based on their RFM scores.

-

Targeted Actions: Develop tailored marketing strategies for each segment to maximize ROI.

Conclusion

RFM analysis is a game-changer for businesses looking to optimize customer relationships and revenue. By understanding and acting on these insights, you can turn casual buyers into loyal advocates and re-engage those at risk of churning. Start leveraging RFM today to unlock the full potential of your customer data!

Ready to dive deeper into RFM analysis? Lets discuss further !!!